Movie Production Market USA 2024

Hollywood is by far the world’s largest movie production market, accounting for over 85% of global box office revenues, exporting around $34 billion worth of entertainment content, and contributing more than $49 billion annually to the United States economy.

With this hub of movie-making spending around $15 billion each year on film production, it’s clear that despite changing consumer behaviors and economic factors, the largest international film market will continue to dominate in 2024 and beyond. Here’s how the latest statistics play out.

US Market Size, Growth and Forecasts

According to World Metrics, Hollywood represents around 40% of the global film market and earns in excess of 70% of all film production revenues in the US. It also accounts for up to 80% of the world’s entertainment market revenues (box office, streaming, music, and media) and almost 80% of the total film revenue earned in North America.

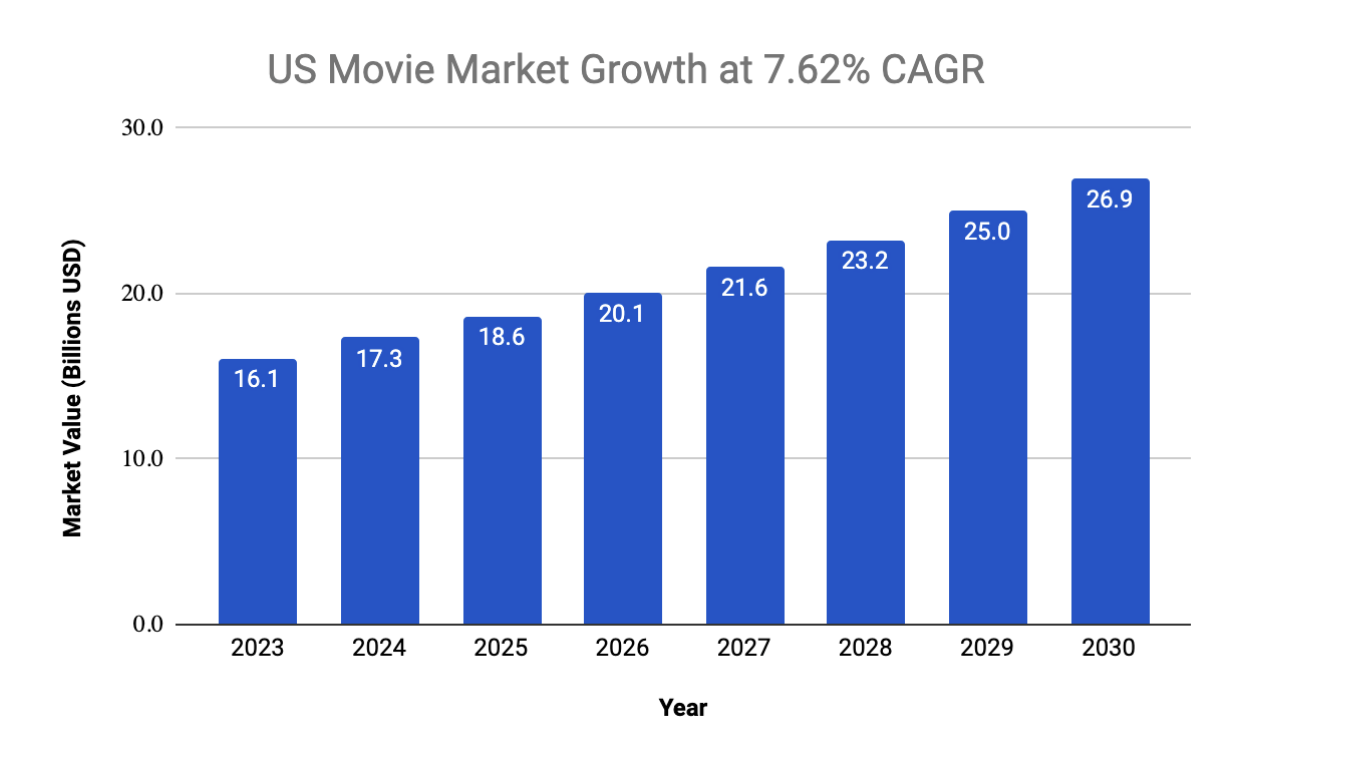

Research and Markets United States Movie Market Analysis 2024-2030 report sheds more light on the size and projected growth of the US’s thriving movie production industry. The report estimates that the US movie market will be worth around $26.92 billion by 2030, growing exponentially from its value of $16.1 billion in 2023.

Additionally, the report notes that the US market is projected to grow at a CAGR of 7.62% between 2024 and 2030, showing impressive expected growth rates.

Market Concentration and Characteristics

The movie production market in the United States is diverse. It encompasses box office films, music, videos, and other immersive forms of media that the public loves. Taking a look at the general market, movies (box office) were the segment with the largest revenue generation power as of 2023.

Data from Grand View Research shows that music and videos are projected to be the most lucrative product segment within the greater market. It’s currently showing the fastest growth potential between 2018 and 2030.

Horizon Grand View Research further reveals that box office movies were the largest segment of the movie production market in 2023, boasting an impressive revenue share of 60.62%.

What are the Key Drivers of the Movies and Entertainment Market?

The movies and entertainment market in the US is driven by a handful of unique factors that have allowed it to become the largest and most well-known market in the world.

The demand for films and entertainment in the US has steadily increased in recent years. This increase is driven by trends like theatrical movie releases, which provide viewers with chances to interact socially and enjoy a unique collective social experience.

Going to the cinema has long been a culturally important pastime for US citizens as it provides novel entertainment that can be shared among families, friend groups, and communities. The appeal of blockbuster films is also as strong as ever despite the rise of globalization in the film industry. Major American film studios are investing heavily in big-budget movie productions with advanced visual effects and immersive storylines, allowing them to take advantage of consistent demand for premium entertainment.

Product Trends

Thanks to new technologies, the film industry is evolving rapidly in 2024. The changing desires and preferences of audiences in the US and abroad also play key roles.

According to director Michael Bay, some of the key trends that will shape the industry this year and beyond include:

- Artificial intelligence

- Augmented and virtual reality

- Increasing dominance of streaming platforms

- More inclusion and diversity in movie storytelling

Bay says that AI is transforming the film industry by enhancing production processes at every level. It does this in many ways, from writing scripts to creating visual effects and editing raw footage. Artificial intelligence has the power to analyze large data sets, boost creativity in production, predict the performance of box office films, and improve post-production processes. This allows for the creation of films that align with the preferences of international audiences.

AR and VR-optimized films are gaining momentum, too. These movies offer engaging experiences for viewers across numerous genres, from action to fantasy. Plus, they allow audiences to use specialized headsets, glasses, or goggles to interact with virtual environments, effectively placing them right at the heart of the action and deeply engaging them as a result.

The Rise of Streaming Services

Streaming platforms like Amazon Prime and Netflix are taking the market by storm. They no longer function purely as film distribution channels but as production studios in their own right.

While major production companies still dominate Hollywood, smaller streaming studios are changing how films are produced, released, and financed. This is giving filmmakers new opportunities to create tailor-made content for streaming users and granting them unsurpassed levels of freedom to experiment with content, formats, and run times.

However, instead of taking over, cinema and digital streaming are expected to become more balanced revenue contributors in 2024 as the two industries work to reshape the entertainment landscape together.

Market Share by US Region

State by state, the US film production market is divided into:

Of these states, California remains the most dominant movie production market in 2024. However, the Golden State’s lead has experienced some shrinkage on a global scale. In 2023, it recorded a 27% share of employment, compared to 35% in 2022. Now that the pandemic is firmly in the rearview mirror and the writer strikes are over, this figure may well increase again in the 2024-2025 period.

Who are the Key Vendors in the Movies and Entertainment Market?

As of mid-2024, all the most expensive film productions in history were either made by or in collaboration with US studios. This includes successful franchises such as Star Wars, Pirates of the Caribbean, and the Marvel Cinematic Universe.

There are a few major film studios in the United States that continue to dominate the film production industry. Columbia Pictures, one of the largest film producers in the world, is also the largest in the US, with annual revenues now exceeding $88.30 billion.

Walt Disney Pictures is the industry’s second-largest vendor, specializing in live-action and feature films. Earning annual revenues of over $82.72 billion, Walt Disney Pictures is one of five production studios owned by the Walt Disney Company. Others include Lucasfilm, Marvel Studios, Searchlight Pictures, and 20th Century Studios.

As of 2023, Paramount Pictures was the US’s third most successful movie production vendor, posting earnings of $30.15 billion. The studio has produced 168 feature films to date, including popular titles like Titanic, Shrek the Third, and the Transformers film series.

Other important vendors in the movies and entertainment market in 2024 include Twenty-First Century Fox, Legendary Entertainment, Universal Studios Hollywood, Marvel Studios and Warner Bros.

On a global scale, the US market’s top players include Paramount Global Class A, Warner Bros., The Walt Disney Company, Sony Group Corp. ADR, Discovery Inc. Ordinary Shares – Class A, Amazon.com Inc., Netflix Inc., Vivendi SE, and Comcast Corp. Class A.

What are the Key Market Trends for the Movies and Entertainment Market?

In 2024, the key market trend for the US movies and entertainment market is one of rapid transformation and expansion. Deloitte’s 2024 Media and Entertainment Outlook report notes that the lines between film, gaming, and TV are becoming increasingly less defined. This is catapulting the sector into a period of unique change to grab the attention of new generations of tech-savvy audiences.

The report explains that media and entertainment firms must prepare to face the rising costs of producing top-tier content.

Tools like Generative AI could help control these expenses by easily identifying captivating content and storylines and allowing producers to release more creative and innovative films and media than ever before.

At the core of these trends is the influence of diverse and technologically inclined young generations. Groups like Millennials, Gen Z, and Gen Alpha are redefining a new era of entertainment and films as they explore novelties that combine elements of movies, TV, video games, and social media.

US Employees in the M&E Market

The movie production and entertainment industry employs hundreds of thousands of talented professionals. Recent information from Statista and the US Bureau of Labor Statistics shows that as of January 2024, 441,700 people worked in both the film and sound recording industries.

This number dropped to around 422,000 workers in 2023. It’s now showing a strong rise this year, creating ideal conditions for the industry’s future growth and expansion.

The Impact of COVID

The 2020 COVID-19 pandemic led to drastic shifts in the film industry, both in the United States and globally. Movies have long been a major creator of value, with global box office revenues reaching an all-time high and topping $42 billion in 2019. At this time, data from the World Economic Forum showed that these revenues constituted nearly a third of the total $136 billion value of the international movie production and distribution sector.

The pandemic turned the content creation industry on its head. It slowed film production considerably and forced the closure of cinemas due to social distancing regulations. Cinema operators reported reductions in movie attendance and a shrinking theatrical window – the amount of time studios showed films in theaters before they were released for streaming, sale and download. The WE Forum notes that since the start of the century, the theatrical window has narrowed by over 2 months. This narrowing was further accelerated by the pandemic.

While it was driven by the pandemic to a degree, this trend also reflected an evolution in viewers’ preferences. Audiences gravitated towards streaming video-on-demand, even before the COVID-19 pandemic began. This prompted movie studios to invest in streaming services and platforms, creating an even more competitive streaming industry.

However, one sector of the movie and entertainment industry thrived during the pandemic. While most production studios faced high expenses to support safety equipment and PPE (adding around 5% to total production costs, according to the California Film Commission), animation studios were already well-suited to remote work.

This, combined with a lack of sets, allowed writers, directors and animators to produce a surge of new animated films and series. The shift, in turn, led to a consumer trend towards favoring animations, with the industry growing 4% year-on-year since 2020.

Use of AI

Artificial intelligence is becoming a mainstay across dozens of key industries, including film production. Data from World Metrics’ AI in the Movie Industry Statistics report predicts that AI will generate $886 million in the global movie industry in 2024.

The report also reveals that up to 70% of major production companies will incorporate AI into their processes in 2024, with notable benefits. AI-based analytics can predict box office release performance with an astounding accuracy rate of 86%. Production studios like 20th Century Fox are already using AI to analyze film trailers and predict how audiences will receive them. This feat has successfully increased their ticket sales.

AI’s potential applications in the film industry are myriad. Artificial intelligence tools can analyze scripts, generate movie trailers targeted towards different viewer segments, and assess audiences’ sentiments towards releases on social media. These capabilities can all be used to supercharge new movie marketing strategies.

Some studios use AI to enhance their film distribution practices, allowing new releases to achieve maximum reach and profit levels. Others use AI tools to generate more realistic and captivating CGI effects, helping to improve the visual quality of both live-action and animated movies. AI editing tools can also reduce post-production times and production expenses for filmmakers and studios alike.

The technology can even be used to analyze audiences’ unique preferences and recommend personalized entertainment. This helps to increase viewer engagement and keeps audiences immersed for longer. It aligns well with consumer trends towards streaming services, allowing the film industry to create targeted entertainment that meets their audiences’ specific preferences across various delivery channels.

US Film Production Market Staying In The Spotlight

As these statistics show, the US movie production market is seeing renewed growth in 2024. It has largely recovered from the impacts of the COVID pandemic and is now being streamlined by new tools and technologies to further fuel its progress.

Avid film aficionados can expect exciting new releases from some of the industry’s key players like Universal, Paramount, Disney Pictures, and Warner Bros. There will also be plenty of entertainment released from smaller studios and streaming platform studios this year and beyond.

Unsurprisingly, the future looks bright for the world’s largest film production market, especially with tools like AI, AR, and VR creating more immersive and captivating viewing experiences than ever before.

Best Film Production Software: USA 2025

Find out what filmmakers value most in their software tools, from editing support to progress tracking and post-production help, and learn why Pzaz is the ultimate creative partner in bringing your stories to life.

Film Task Management Statistics: USA 2025

Discover key film task management statistics from 1,063 independent US filmmakers in 2025. Learn how they handle deadlines, tools, team updates, and task dependencies to keep productions on track.

SCRIPTWRITING

SCRIPTWRITING STORYBOARDING

STORYBOARDING SCENE BREAKDOWN

SCENE BREAKDOWN SHOT LIST CREATION

SHOT LIST CREATION CREW & CAST MANAGEMENT

CREW & CAST MANAGEMENT COLLABORATION TOOLS

COLLABORATION TOOLS PRODUCTION & SCHEDULING

PRODUCTION & SCHEDULING FILE SHARING & MEDIA STORAGE

FILE SHARING & MEDIA STORAGE